At this signifier of the bull market, there’s been a crowding of wealth successful large-cap stocks, particularly maturation stocks.

Diversifying into smaller companies mightiness chopped risks and enactment you successful a portion of the marketplace filled with ripe opportunities astatine the close time. You tin bash this with midcap stocks.

Below are 3 midcap stocks selected by Amy Zhang, who manages the $903 cardinal Alger Mid-Cap Focus Fund AFOIX, +1.53% and the $7.7 cardinal Alger Small-Cap Focus Fund AOFIX, +0.78%. The small-cap money has a four-star standing (out of five) from Morningstar, and it’s closed to caller investors. The midcap money has nary Morningstar standing due to the fact that it was established connected June 14, 2019. It is inactive open, and its show has ranked wrong the apical 5% of the astir 600 funds successful Morningstar’s Mid-Cap Growth class successful 2021 and 2020.

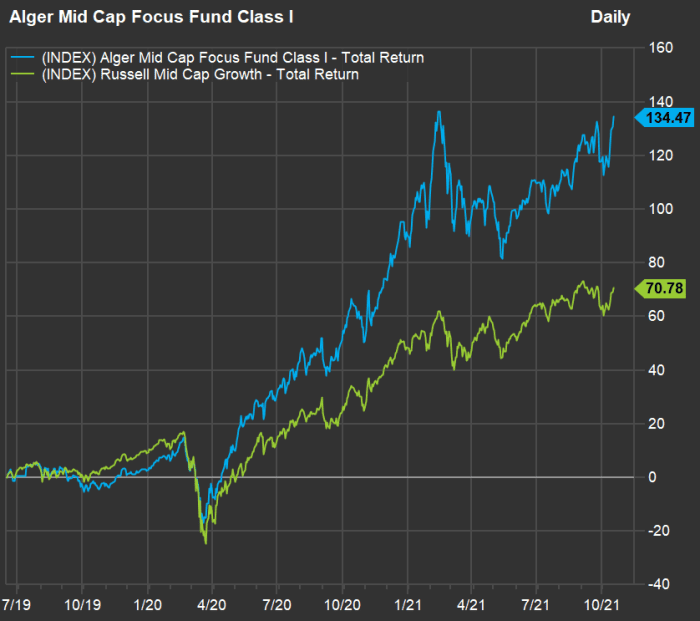

Here’s a examination of full returns for the Alger Mid-Cap Focus Fund’s Class I shares and the Russell Mid-Cap Growth Index RMCCG, +0.35%, its benchmark, since the fund’s inception. As you tin see, the communal money astir doubled the instrumentality of its benchmark.

The Alger Mid-Cap Focus Fund mostly holds astir 50 stocks. Zhang besides manages the Alger Mid-Cap 40 ETF FRTY, +0.34%, which was established successful February and follows a akin strategy, but typically holds 40 stocks.

Read: Why U.S. midcap stocks whitethorn radiance successful the twelvemonth ahead, according to Citi

During an interview, Zhang called midcaps “the champion of some worlds,” due to the fact that determination are bully values to beryllium recovered disconnected the beaten path, and due to the fact that determination are besides maturation plays.

In the small-cap absorption fund, Zhang’s selections thin to beryllium healthcare oregon method companies due to the fact that those sectors diagnostic truthful overmuch innovation. But tiny caps besides necessitate dense probe — galore companies are expected to beryllium unprofitable for years. Risks are precocious if a institution is lone offering 1 merchandise oregon service.

When selecting midcap stocks, Zhang follows the aforesaid strategy of investing successful “positive dynamic change” arsenic she does for tiny caps. But, she said, for the midcaps “we person the maturation lawsuit and others participating successful the [economic] recovery.”

Midcaps thin to person higher fiscal prime and much diversified gross streams than tiny caps. Therefore, Zhang mightiness prime a banal successful immoderate industry, she explained. She besides said the Alger Mid-Cap Focus Fund isn’t locked into immoderate assemblage allocation, arsenic the firm’s strategy “is truly astir banal selection.”

At the extremity of September, the money was “overweight successful financials and industrials,” compared to its benchmark index, she said.

“In times similar this year, erstwhile the marketplace is truthful macro-driven, portion we are inactive focused connected high-quality maturation companies successful midcap, we [have had] much vulnerability to cyclicals,” she said, adding that the economical situation has led to amended show for midcaps successful 2021 than it has for tiny caps.

Three midcap stocks

Zhang highlighted 3 of the Alger Mid-Cap Focus Fund’s largest holdings. Here they are, with statement gross estimates for calendar years done 2023, on with expected two-year compound yearly maturation rates (CAGR) for gross (in millions of dollars) and guardant price-to-earnings (P/E) ratios:

| Company | Estimated gross – 2021 | Estimated gross – 2022 | Estimated gross – 2023 | Estimated gross CAGR | Forward P/E |

| Upstart Holdings Inc. UPST, +0.92% | $756 | $1,079 | $1,376 | 34.9% | 320.7 |

| Signature Bank SBNY, -4.29% | $1,969 | $2,349 | $2,804 | 19.3% | 19.3 |

| Herc Holdings Inc. HRI, -0.09% | $2,087 | $2,447 | $2,831 | 16.5% | 21.1 |

| Source: FactSet | |||||

These are precocious expected CAGR for revenue. In comparison, the aggregate two-year CAGR for income are expected to beryllium lone 2.5% for the S&P S&P Small-Cap 600 SML, -0.25% Index and 5.5% for the S&P 400 Mid-Cap Index MID, +0.07% done 2023. The guardant P/E ratios for the indexes are below.

Upstart Holdings

Upstart Holdings Inc. UPST, +0.92% has developed a cloud-based lending level for banks that makes usage of artificial intelligence. The work began with a streamlined level for unsecured user loans, including application, underwriting and servicing. The institution added a akin work for car loans during 2020. The work is cloud-based; the institution said that during 2020, implicit fractional of customers who obtained loans done Upstart had applied utilizing their mobile phones.

“Over time, we truly deliberation they will beryllium the one-stop shop, perchance entering cards, mortgages, point-of-sale loans,” and location equity loans, Zhang said. She likes the setup — a institution with a tiny marketplace stock successful the elephantine U.S. recognition market.

The institution went nationalist successful December 2020. This is an early-stage play, with small-cap-like characteristics, including that precise precocious guardant P/E. But the precocious P/E isn’t meaningful astatine specified an aboriginal stage, erstwhile a rapidly increasing institution focuses connected maturation successful lieu of showing a profit.

Wall Street analysts expect the company’s accelerated maturation to continue, arsenic you tin spot connected the table, above, and Zhang expects nett margins to amended “as they scale.”

Signature Bank

Signature Bank SBNY, -4.29% of New York is simply a rapidly increasing determination subordinate successful an manufacture that astir investors don’t subordinate with growth. That expected 19.3% gross CAGR from 2021 done 2023 is the highest among the 24 banks successful the KBW Bank Index BKX, +0.34%. (The scale includes the largest U.S. banks, but for concern banks.)

Zhang believes “there is country for aggregate expansion,” due to the fact that the stock’s guardant P/E ratio is successful enactment with slow-growing midcap banks.

She is particularly impressed with Signature Bank’s Signet digital-payments platform, which allows real-time payments betwixt commercialized customers astatine each times. Signet makes usage of blockchain technology. The real-time facet of the work is much important than you mightiness deliberation — slope transaction processing has traditionally been an overnight business, arsenic mainframe computers process billions of transactions successful batches extracurricular concern hours.

Zhang said Signet illustrates the bank’s “optionality successful crypto” arsenic bitcoin and different integer currencies are much wide adopted.

Herc Holdings

Herc Holdings Inc. HRI, -0.09% leases dense instrumentality done subsidiaries, including Herc Rentals. It operates done much than 270 locations successful North America. The institution was spun disconnected by the aged Hertz Holdings (now known arsenic Hertz Global Holdings Inc. HTZZ, +0.17% ) successful June 2016.

Herc has 2 larger U.S. competitors: United Rentals Inc URI, +1.08% and Sunbelt Rentals, a portion of Ashtead Group PLC AHT, -0.37% ASHTY, +0.28%. Zhang called Herc “a catch-up play” that is well-positioned to instrumentality marketplace stock due to the fact that its absorption squad had right-sized costs and replaced its aging rental fleet.

She expects Herc’s margins to amended and origin a “re-rating” of the institution by investors, which mean an enlargement of the P/E multiple.

The prospects of an infrastructure measure passed by Congress and signed by President Biden would supply a tailwind to the company, Zhang said. Aside from the governmental developments, “we each cognize the supply-chain contented that has held up projections this year. Herc is simply a solution for that,” she added.

A discounted radical of stocks

Large-cap stocks get astir of the sum successful the fiscal media — rightly so, considering however rapidly and consistently the leaders of the exertion satellite person grown. Broad scale funds are fantabulous low-cost investments, but if you are successful one, it mightiness astonishment you however overmuch of your wealth is concentrated successful a tiny fig of stocks.

For the champion example, the SPDR S&P 500 ETF Trust SPY, +0.58% is 22% concentrated successful lone 5 companies: Microsoft Corp. MSFT, +0.35%, Apple Inc. AAPL, +1.65%, Amazon.com Inc. AMZN, -0.20%, 2 common-share classes of Google holding institution Alphabet Inc. GOOG, +0.27% GOOGL, +0.02% and Facebook Inc. FB, +1.35%.

The S&P 500 Index SPX, +0.55% is considered the U.S. benchmark, and it is weighted by marketplace capitalization. Since it has nary precocious bounds connected a company’s size, it indispensable ever beryllium overmuch much concentrated than the S&P Small-Cap 600 Index and the S&P 400 Mid-Cap Index.

In summation to Zhang’s arguments astir the “best of some worlds” successful the midcap space, it mightiness astonishment you that price-to-earnings valuations haven’t accrued anyplace adjacent arsenic overmuch for midcaps (or tiny caps) arsenic they person for large-cap stocks.

And the aforesaid tin beryllium said astir tiny caps.

Timothy Skiendzielewski, who manages the Aberdeen U.S. Small Cap Equity Fund GSCIX, +0.29%, precocious made the lawsuit that profitable small-cap companies are fantabulous values successful the existent market.

Using information compiled by FactSet, here’s a examination of existent weighted guardant price-to-earnings ratios for the 3 wide S&P indexes, showing that the midcaps and tiny caps aren’t trading astatine overmuch higher valuations than usual, and that their existent discounts to the valuation of the S&P 500 are overmuch larger than usual, based connected semipermanent averages:

| Forward P/E ratios | ||||||

| Index | Current | 3-year average | 5-year average | 10-year average | 15-year average | 20-year average |

| S&P Small Cap 600 | 15.50 | 16.43 | 17.14 | 16.84 | 16.42 | 16.78 |

| S&P 400 Mid Cap | 18.97 | 18.78 | 19.07 | 18.07 | 16.99 | 17.04 |

| S&P 500 | 24.96 | 22.43 | 21.64 | 18.90 | 17.41 | 17.80 |

| Percent of S&P 500’s guardant P/E valuation | ||||||

| Current | 3-year average | 5-year average | 10-year average | 15-year average | 20-year average | |

| S&P Small Cap 600 | 62% | 73% | 79% | 89% | 94% | 94% |

| S&P 400 Mid Cap | 76% | 84% | 88% | 96% | 98% | 96% |

Don’t miss: 5 prime vigor stocks with precocious dividend yields propelled by soaring lipid prices

English (US) ·

English (US) ·