Is XDC a Good Investment Compared to Other Altcoins?

In a crypto market flooded with over 20,000 altcoins, its not easy to separate hype from genuine value. Most tokens promise big ideas but fail to deliver on real-world use cases. This brings us to XDC (XDC Network) a blockchain thats quietly building an enterprise-grade infrastructure focused on global trade, tokenization, and financial compliance.

But with so many options like Solana, Polkadot, and Chainlink, many investors ask: Is XDC a good investment compared to other altcoins? In this deep-dive, we compare XDC with competing altcoins, analyze its fundamentals, and evaluate whether it's a smart addition to your long-term portfolio.

? XDC vs Other Altcoins: Key Metrics

Lets begin by comparing some core statistics between XDC and a few well-known altcoins:

| Metric | XDC | Solana | Polkadot | Chainlink |

|---|---|---|---|---|

| Market Cap | ~$650M | ~$28B | ~$6.5B | ~$12B |

| All-Time High | $0.19 | $260 | $55 | $53 |

| Current Price (2025) | ~$0.045 | ~$58 | ~$5.50 | ~$20 |

| Use Case | Trade finance, tokenization | Scalable DeFi & NFTs | Interoperability | Decentralized Oracles |

| Consensus Model | XDPoS (Delegated) | Proof-of-History | NPoS (Nominated) | N/A (oracle layer) |

| Token Utility | Gas, staking, liquidity | Gas, staking | Governance, staking | Oracle request payments |

| Target User Base | Enterprises, institutions | Developers, dApps | Multi-chain builders | Data-driven dApps |

From the table, we can see that XDC has a unique niche: Its not focused on DeFi hype, but on institutional finance and real-world tokenization areas often underserved by most public blockchains.

? XDCs Strategic Advantage: Enterprise-First Blockchain

? Compliance and Regulation Ready

Unlike many other Layer 1s, XDC Network is built for institutions. Its hybrid architecture (public + private chain) ensures that financial institutions can maintain privacy while benefiting from blockchain transparency.

This makes XDC attractive to governments, trade organizations, and banks a growing segment in blockchain adoption.

?? Real-World Adoption

Projects like:

-

TradeFinex (tokenized trade finance)

-

Impel (blockchain messaging for banks)

-

CargoX (supply chain documents on blockchain)

all use XDC as their underlying technology a clear signal of real usage, not just speculation.

? Fast and Low-Cost

XDC handles over 2,000 transactions per second (TPS) with near-zero gas fees perfect for microtransactions, token settlements, and cross-border value transfers.

This stands in contrast to Solanas occasional outages or Ethereums gas spikes.

? Why XDC May Outperform in the Long Run

? 1. Niche Market: Trade Finance

XDC isnt trying to be everything to everyone. Its focus on $5 trillion+ trade finance gives it a clear mission.

The World Economic Forum has identified trade finance as one of the most promising areas for blockchain and XDC is already at the forefront of this revolution.

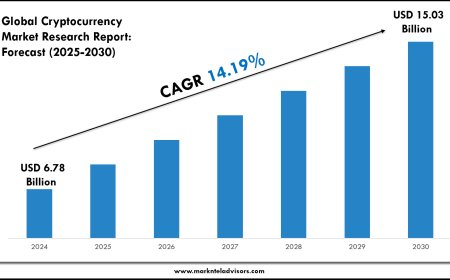

? 2. Low Valuation = High Upside

At a market cap below $1 billion, XDC is considered undervalued by many analysts.

If XDC reaches even 1% of Ethereums market cap, it could 10x from current levels without needing speculative hype.

? 3. Underrated DeFi Ecosystem

While smaller than Ethereum or Solana, XDCs DeFi ecosystem includes:

-

XSwap: The first AMM DEX on XDC

-

Globiance: Hybrid crypto-banking exchange

-

Fathom: Stablecoin + lending

-

Plugin: Oracle layer for real-time data

These are quietly attracting liquidity and use, especially in markets underserved by traditional DeFi.

? What About the Risks?

?? 1. Lack of Hype

XDC doesn't have the same retail visibility as Solana or Dogecoin, which may limit short-term price pumps.

?? 2. Exchange Listings

Still not available on Coinbase, Kraken, or Binance US, which limits volume and discovery.

?? 3. Centralized Validator Concerns

Its Delegated Proof of Stake (XDPoS) model is efficient but critics say it's less decentralized than Ethereum or Bitcoin.

?? 4. Slow Ecosystem Growth

Without aggressive developer incentives or VC money, XDCs growth may be slower than rivals unless large institutional partners accelerate usage.

? Investment Case Summary: XDC vs Altcoin Leaders

| Factor | XDC | Solana | Chainlink |

|---|---|---|---|

| Hype Factor | Low | High | Moderate |

| Real-World Use | High (B2B) | High (B2C) | High (Data) |

| Tech Efficiency | High | High | N/A |

| Price Volatility | Low | High | Moderate |

| Long-Term Value Prop | Strong | Strong | Strong |

| 5-Year ROI Potential | 5x10x | 2x4x | 3x6x |

If your goal is fast returns through hype, XDC may not be your best choice. But if youre looking for undervalued, real-world utility XDC stands out.

? Expert Takes: What Analysts Say

-

CryptoNewsZ: XDC is the most enterprise-ready blockchain that most people have never heard of.

-

DigitalCoinPrice: Forecasts XDC reaching $0.18$0.25 by 2029.

-

Uphold: Selected XDC as one of the top enterprise coins alongside XRP and ALGO.

-

Forbes Contributor: A quiet achiever in the tokenization of real-world financial assets.

Experts consistently note that XDC has more value under the hood than its price currently reflects.

? Price Forecast Compared to Competitors

| Year | XDC Price Target | Solana Target | LINK Target |

|---|---|---|---|

| 2025 | $0.08$0.12 | $75$100 | $25$30 |

| 2027 | $0.15$0.25 | $120$150 | $35$50 |

| 2030 | $0.30$0.50 | $180$250 | $60$80 |

Given the current price of ~$0.045, even a move to $0.30 would represent a 6x return while still being a conservative estimate based on utility-driven growth.

? Conclusion: Is XDC a Good Investment Compared to Other Altcoins?

Yes, XDC is a strong long-term investment especially when compared to speculative or hype-driven projects.

While it may not explode overnight like meme coins or heavily marketed L1s, XDC offers:

-

Real-world utility

-

Sustainable tokenomics

-

Institutional-grade technology

-

Undervalued market position

If you believe the next crypto cycle will reward real adoption over empty promises, then XDC is not just a good investment it might be one of the smartest ones.