What to look for in a senior citizen health insurance policy

One name that has consistently stood out in offering thoughtful, transparent, and senior-friendly plans is Niva Bupa Health Insurance.

As our loved ones age, their healthcare needs become more frequent, and unfortunately, more expensive. That's why health insurance for senior citizens in India is not just a financial safety netit's peace of mind. With rising medical costs and an increase in age-related ailments, having a robust health insurance policy becomes critical.

But with so many health insurance plans for senior citizens flooding the market, how do you choose the right one? Lets explore the key factors you should consider when selecting the best health insurance policy for senior citizens in India.

1. Entry Age and Renewability

When it comes to senior citizens, the age criteria are the first box to check. Many insurers limit the entry age to 60-65, while some offer coverage beyond that. Make sure the plan allows entry at the age your parents or elderly loved ones currently are.

Additionally, lifetime renewability is a must. You dont want to keep switching policies once your parents cross a certain age. A plan that offers lifelong renewability ensures they stay covered without the stress of reapplying later.

Pro tip: Always confirm the upper limit of entry age and whether the policy mentions lifetime renewability in writing.

2. Coverage for Pre-Existing Diseases

Most health insurance plans for senior citizens come with a waiting period for pre-existing conditions like diabetes, hypertension, or heart ailments. However, the shorter this waiting period, the better.

Typically, waiting periods range from 12 to 48 months. Choose a policy that offers minimal waiting time, especially if the insured already has a medical history.

Look for plans that not only cover pre-existing illnesses but also dont heavily cap the treatment costs for these conditions.

3. Daycare Procedures and OPD Benefits

Senior citizens may not always require long hospital stays. With advancements in medical science, many surgeries and treatments are completed in less than 24 hours. These are called daycare procedures.

The best health insurance policy for senior citizens will cover a wide list of daycare treatments, including cataract surgery, dialysis, chemotherapy, etc. Additionally, plans that offer Outpatient Department (OPD) benefitscovering doctor consultations, medicines, and diagnostic testscan be very useful for seniors who need regular check-ups.

4. Cashless Hospital Network

Having a vast network of cashless hospitals makes hospitalisation much less stressful, especially for the elderly. In a medical emergency, running around for claim reimbursements can be emotionally and physically taxing.

Choose a plan that includes a wide hospital network, especially ones that are easily accessible from your home. This ensures seamless treatment without upfront payment hassles.

Tip: Check if the policy offers a dedicated claim assistance helpline or a claims relationship manager, especially for senior citizens.

5. Co-Payment Clause

Many health insurance plans for senior citizens include a co-payment clause, which means the policyholder must bear a percentage of the medical expenses out of pocket. This could range from 10% to 30%, depending on the insurer and the age of the insured.

While this clause helps lower the premium, it might not be ideal if you're looking to reduce out-of-pocket expenses. If affordability isn't a major issue, opt for a plan with low or no co-payment.

A lower co-payment percentage means greater financial relief at the time of hospitalisation, especially during high-cost treatments.

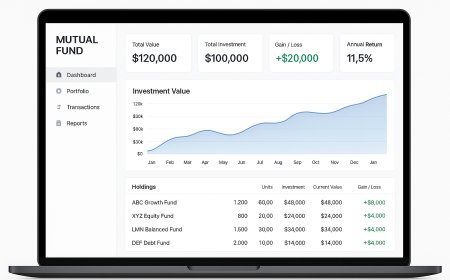

6. High Sum Insured with Affordable Premium

As people age, the chances of hospitalisation increase, which also raises the overall cost of treatment. Therefore, opt for a plan with a high sum insured, ideally ?5 lakh or more, based on your familys needs and medical history.

But dont go overboard either. Balance is key. The best health insurance policy for senior citizens should offer adequate coverage without making premiums unaffordable. Look for premium discounts on family floater plans or multi-year payments.

7. Critical Illness and Domiciliary Care

Many senior citizens face life-threatening conditions like cancer, stroke, or kidney failure. A plan that includes critical illness coverage can be a real financial shield.

Also, some illnesses may require domiciliary care, where treatment is provided at home instead of a hospital. This is especially important if mobility is an issue or during pandemics. Make sure the plan offers decent coverage for at-home treatments.

Always read the policy document for sub-limits or exclusions related to critical illnesses.

8. No Claim Bonus (NCB)

If your senior citizen family member doesnt make any claims during a policy year, they should be rewarded! Many insurers offer a No Claim Bonus, which increases the sum insured without increasing the premium.

Its a great way to accumulate more coverage over time. The best health insurance policy for senior citizens will offer NCB benefits even on continuous renewals, providing a long-term advantage.

9. Minimal Sub-Limits and Restrictions

Watch out for sub-limitsrestrictions on room rent, ICU charges, or specific treatments. For example, some policies may only allow ?2,000 per day for room rent, which might not be sufficient in metro cities.

Choose a plan with minimal sub-limits or one that offers room rent waiver or no sub-limit options. These may come with a slightly higher premium but offer much better value in times of crisis.

10. Dedicated Senior Citizen Services

Elderly individuals often require more handholding during the insurance journeywhether it's understanding the paperwork, navigating hospitalisation, or tracking claims.

Some insurers offer dedicated helplines, home pickup for documents, annual health checkups, and even concierge services tailored for seniors. Such add-ons can be invaluable and should influence your decision while comparing health insurance plans for senior citizens.

Final Thoughts

When buying best health insurance for senior citizens in India, the cheapest option is rarely the best. Look beyond premiumsevaluate the claim process, benefits, exclusions, and customer reviews. Remember, the goal is not just to save money, but to ensure quality treatment during lifes most vulnerable moments.

One name that has consistently stood out in offering thoughtful, transparent, and senior-friendly plans is Niva Bupa Health Insurance. Known as one of the best health insurance companies in India, Niva Bupa offers a range of options for senior citizens that include features like lifelong renewability, pre-existing condition coverage, and a wide hospital network.