Mortgage Payment Software: Simplifying Servicing and Borrower Payments in 2025

Learn how mortgage payment software improves servicing, automates compliance, and enhances borrower experience for lenders and credit unions in 2025.

In todays competitive and highly regulated mortgage environment, loan servicing is no longer just about collecting monthly payments. Its about delivering a digital-first experience to borrowers, maintaining strict compliance, and managing escrow, interest, and delinquency workflows at scale. Enter mortgage payment softwarea specialized solution that makes all of this possible through automation.

As we step into 2025, lenders and servicers must prioritize modern technology to meet borrower expectations, reduce errors, and streamline operations. This guide covers everything you need to know about mortgage payment software, from features and benefits to choosing the right provider.

What Is Mortgage Payment Software?

Mortgage payment software is a post-closing technology platform designed to manage the repayment phase of a mortgage. It automates recurring payments, calculates interest and principal, manages escrow for taxes and insurance, and generates required documentation such as monthly statements and annual tax forms.

It is used by mortgage lenders, servicers, banks, credit unions, and private lending firms to ensure accuracy, reduce costs, and deliver better borrower experiences.

Why Mortgage Payment Software Is Critical in 2025

With increasing borrower expectations, regulatory scrutiny, and servicing costs, mortgage payment software has become a must-have for organizations involved in mortgage servicing. Heres why:

1. Borrowers Expect Convenience

Digital natives want to pay online, check their balances, receive instant reminders, and download their tax formsall from their phones or computers.

2. Regulations Are Stricter

Federal and state laws such as RESPA and CFPB guidelines require timely disclosures, proper escrow accounting, and detailed delinquency notices. Software helps meet these obligations.

3. Manual Processes Are Costly

Manual payment processing, statement generation, and escrow tracking are prone to errors and consume time. Automation helps reduce servicing costs and staff workload.

4. Portfolio Management Needs Scalability

As lenders grow, so does the complexity of managing thousands of mortgage accounts. A robust payment platform enables scalability without compromising accuracy.

Key Features of Modern Mortgage Payment Software

When evaluating a mortgage payment platform, look for the following essential features:

1. Online and Automated Payment Processing

Accept ACH, debit/credit cards, and digital wallets. Allow borrowers to set up recurring payments and receive payment confirmations.

2. Real-Time Amortization and Balance Tracking

Automatically apply payments to interest, principal, and escrow. Generate real-time amortization schedules and update loan balances after each payment.

3. Escrow Management

Track taxes and insurance, pay escrow bills on time, calculate shortages/surpluses, and issue annual escrow statements.

4. Monthly Statement Automation

Generate and send monthly mortgage statements, payment reminders, and late notices digitally or via mail.

5. Delinquency and Late Fee Handling

Automatically flag missed payments, apply late charges, and initiate delinquency communication per regulatory timelines.

6. Borrower Self-Service Portal

Offer borrowers a secure portal to make payments, view statements, download tax documents, and request account support.

7. Mobile App Integration

Provide a responsive mobile interface that works across iOS and Android, giving borrowers full account control on-the-go.

8. Compliance Management

Ensure timely notifications, track document delivery, and maintain audit-ready logs for all servicing activity.

9. System Integration

Integrate with LOS (Loan Origination Software), CRMs, investor reporting systems, and accounting platforms using APIs.

Benefits for Lenders and Loan Servicers

Mortgage payment software delivers tangible benefits to servicing organizations of all sizes:

1. Reduced Processing Costs

Automation eliminates repetitive manual tasks like payment application, escrow calculations, and notice generation.

2. Lower Error Rates

Software ensures consistent payment handling and reduces risk of misapplied funds or missed compliance deadlines.

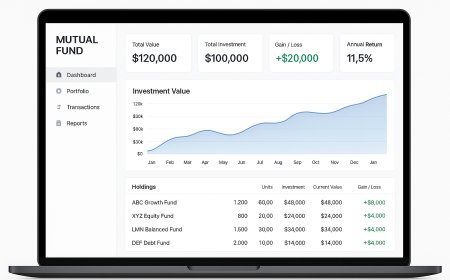

3. Real-Time Insights

Daily dashboards show payment status, escrow activity, and delinquency ratessupporting better operational decisions.

4. Regulatory Readiness

Meet RESPA, CFPB, and investor-specific requirements without manually tracking every deadline or disclosure.

5. Enhanced Borrower Satisfaction

Timely notifications, digital access, and payment flexibility lead to happier customers and improved retention.

Benefits for Borrowers

Borrowers directly benefit from software-enabled servicing:

-

Access: 24/7 portal access to view balances and statements

-

Convenience: Multiple payment options including auto-pay and mobile payments

-

Transparency: Clear breakdowns of how each payment is applied

-

Support: Easy access to forms, history, and servicing requests

Example: How Mortgage Payment Software Works in Real Life

Lets walk through a typical mortgage payment lifecycle using modern software:

-

Loan Boarding

After closing, loan data is imported. A welcome email and portal access are sent to the borrower. -

Payment Setup

Borrower schedules recurring payments. The software confirms setup and stores payment credentials securely. -

Monthly Payment Processing

Each month, the payment is collected, split into principal, interest, and escrow, and applied automatically. A receipt is emailed. -

Escrow Handling

The system pays property taxes and insurance from the escrow account, calculates surpluses/shortages, and adjusts monthly escrow if needed. -

Statements and Notices

Digital statements, 1098 tax forms, and escrow analysis documents are auto-generated and delivered to the borrower. -

Delinquency Management

If payment is missed, alerts are sent to both borrower and internal teams. Late fees are applied, and collections workflows begin automatically. -

Final Payoff

When the borrower sells or refinances, a payoff quote is generated instantly. Upon receipt of funds, the loan is marked paid in full.

Leading Mortgage Payment Software Providers in 2025

Here are some of the most reputable and widely adopted mortgage payment platforms:

| Provider | Ideal For | Key Features |

|---|---|---|

| Black Knight MSP | Large lenders | End-to-end loan servicing, strong compliance |

| Sagent LoanServ | Mid-sized servicers | Real-time system, borrower engagement tools |

| FICS Mortgage Servicer | Community banks & CUs | Affordable, escrow tracking, automation |

| LoanPro | Fintech lenders | Custom payment logic, robust API framework |

| Mortgage Automator | Private lenders | Simple UI, all-in-one LOS + servicing tools |

| Nortridge | Diverse loan types | Powerful customization, multi-loan support |

Choosing the Right Platform for Your Needs

Every mortgage servicer is different. Consider the following before making your selection:

1. Portfolio Size and Complexity

Ensure the system can handle your loan volume and mortgage types (e.g., ARM, interest-only, FHA).

2. Borrower Experience

Review the portal and mobile features. A poor borrower UI can drive up support costs and hurt satisfaction.

3. Compliance Automation

Ask whether the software automates CFPB/RESPA notices, generates audit trails, and tracks communication timelines.

4. Integration Capabilities

Check compatibility with your existing LOS, accounting software, and investor reporting systems.

5. Implementation Support

Review the vendors onboarding process, training options, and long-term support model.

Implementation Tips

To ensure success:

-

Plan Ahead: Start with a clear project timeline and team roles.

-

Clean Data: Audit and normalize legacy loan data before migration.

-

Test Thoroughly: Run trial scenarios and test statements, payments, and escrow calculations.

-

Train Your Team: Provide specialized training by role (support, compliance, servicing).

-

Monitor Post-Launch: Track KPIs like delinquency rate, support calls, and borrower satisfaction.

Looking Ahead: The Future of Mortgage Payment Systems

Heres where the industry is headed in the next 25 years:

Real-Time Payments

Using networks like FedNow, payments will post instantlyimproving cash flow and reducing delay-related delinquencies.

AI-Powered Risk Management

AI will detect early signs of hardship and suggest preemptive action or loan restructuring.

Embedded Payments

Mortgage servicing will be embedded into broader fintech and banking platforms for seamless borrower access.

Blockchain-Ledger Records

Immutable, decentralized payment and escrow ledgers may improve transparency and trust.

Voice and Chat Payments

Borrowers will soon be able to pay loans or request documents using Alexa, Google Assistant, or integrated chatbots.